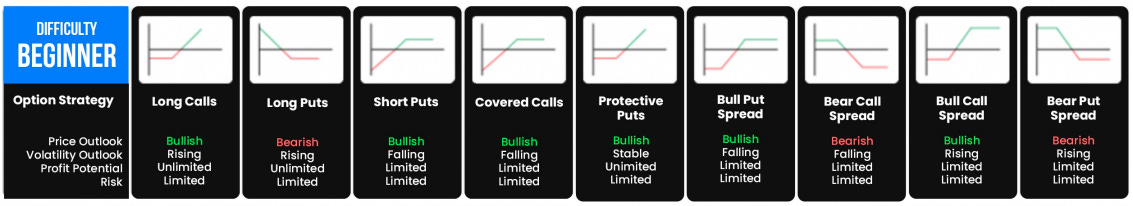

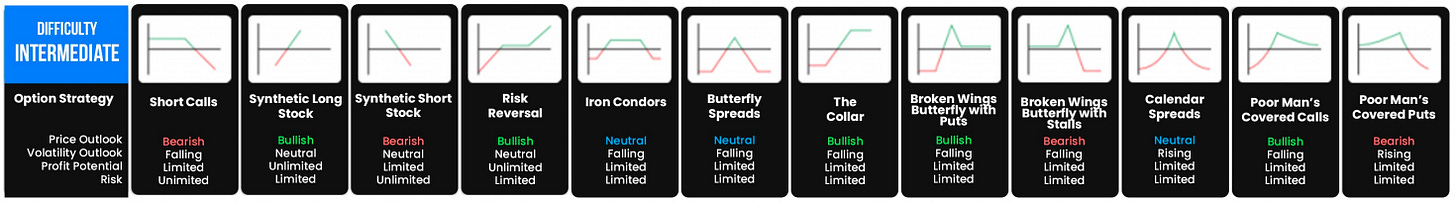

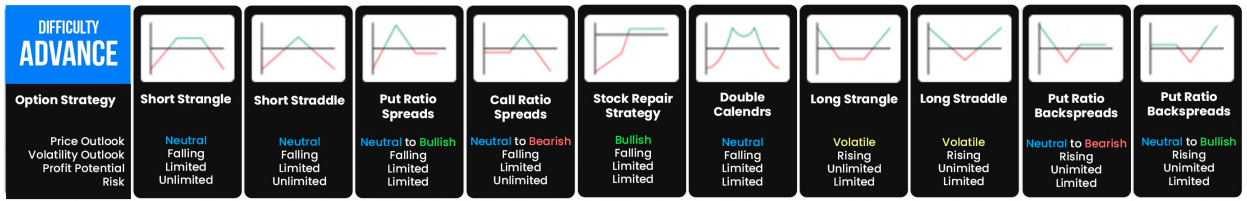

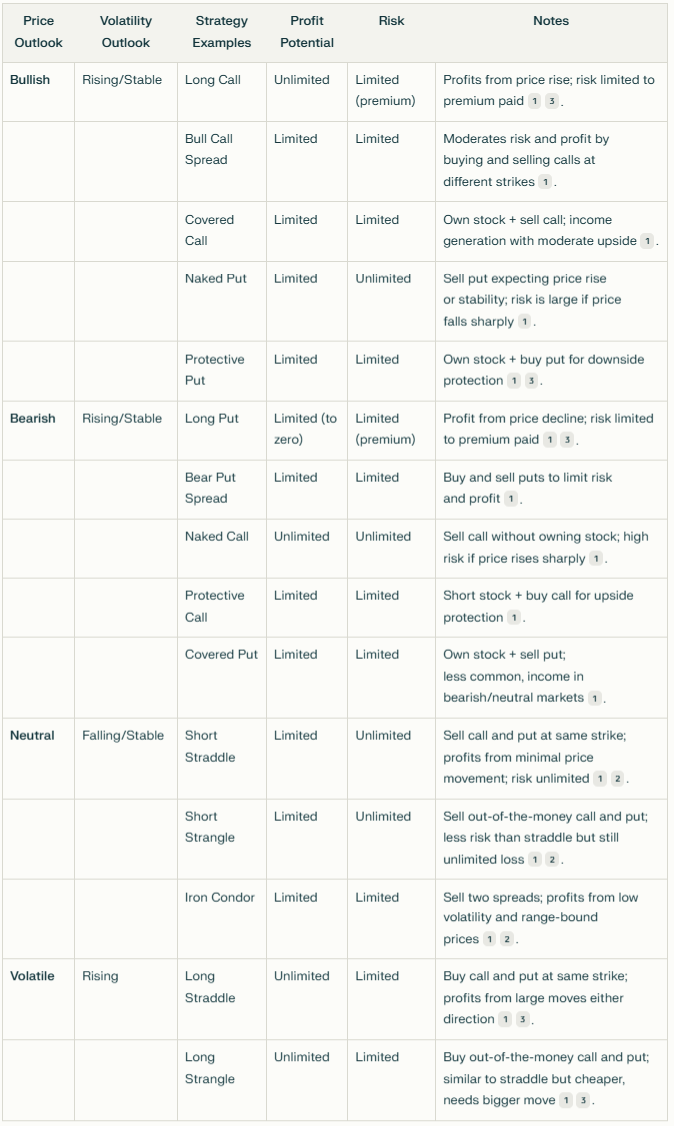

Options Trading Strategies Cheatsheet

based on Price Outlook, Volatility Outlook, Profit Potential, and Risk

Here is a concise cheat sheet grouping popular options strategies based on Price Outlook, Volatility Outlook, Profit Potential, and Risk for quick reference and learning:

Summary of Key Characteristics

Profit Potential:

Unlimited: Long calls, long puts (to zero), long straddles, long strangles.

Limited: Spreads (bull call, bear put), iron condor, covered calls/puts.

Risk:

Limited: Buying options (premium paid), spreads, protective strategies.

Unlimited: Naked short options (naked calls, naked puts), short straddles/strangles.

Volatility Outlook:

Rising Volatility: Long straddle, long strangle (benefit from big moves).

Falling/Stable Volatility: Iron condor, short straddle, short strangle (profit from little movement).

Price Outlook:

Bullish: Long call, bull call spread, covered call, naked put.

Bearish: Long put, bear put spread, naked call, protective call.

Neutral: Short straddle, short strangle, iron condor.

Volatile: Long straddle, long strangle.

This cheat sheet provides a quick reference to select options strategies based on your market view and risk tolerance123. For risk management, consider setting stop-loss orders tailored to each strategy's characteristics to limit losses4.