Understanding the Initial Balance and Opening Range Breakout Strategies: Volume Contribution, Profitability, and Optimal Trading Days

First Hour of Trading Volume Contribution to Daily Volume

The first hour of trading typically accounts for a significant portion of the daily volume. Institutional traders often place their positions during this period, making it a high-activity time. While exact percentages vary by market and instrument, the first hour combined with the last hour before market close often constitutes a large part of the total daily volume. This strong volume concentration helps establish the Initial Balance (IB) range, which is critical for intraday price action analysis25.

Initial Balance (IB) Strategy Concept

Initial Balance Definition: The Initial Balance is the price range formed during the first hour of trading (e.g., 9:30 AM to 10:30 AM in the US markets). It sets a reference range for the rest of the trading day28.

Market Sentiment Indicator: IB acts as a barometer for market sentiment. Price movement outside the IB range (either breaking above the IB high or below the IB low) often signals strong directional moves for the day5.

Trade Opportunities:

Volume & Volatility: The IB period is characterized by high volatility and volume, reflecting institutional activity and setting the tone for the day28.

Is the Initial Balance Strategy More Profitable than Opening Range Breakout (ORB)?

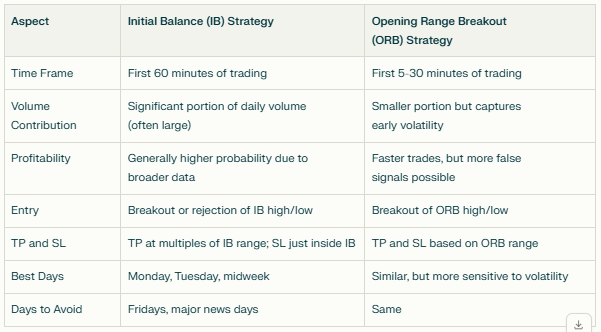

Both IB and ORB strategies focus on early session price ranges but differ slightly in time frame and application.

The IB typically covers the first hour, while ORB often refers to the first 5, 15, or 30 minutes.

IB strategy benefits from capturing a more comprehensive view of early market sentiment and volume, which can lead to higher-probability trades compared to shorter ORB windows28.

However, ORB strategies can be more responsive and suitable for faster intraday trading styles. Profitability depends on market conditions, the trader’s skill in managing entries/exits, and risk management9.

How to Set Entry, Take Profit (TP), and Stop Loss (SL) Using Initial Balance Strategy

Entry:

Take Profit (TP):

Set TP at logical support/resistance levels beyond the IB range or use multiples of the IB range size (e.g., 1x to 2x IB range) for profit targets5.

Partial profit-taking near key intraday levels can help lock gains.

Stop Loss (SL):

Place SL just inside the IB range to protect against false breakouts (e.g., just below IB high for longs or above IB low for shorts)58.

Use tight stops initially, then trail stops as the trade moves in your favor.

Best and Worst Days of the Week to Use Initial Balance or ORB Strategies

Best Days:

Early in the week (Monday, Tuesday) often show clearer IB or ORB patterns as markets digest weekend news and set trends10.

Midweek days (Wednesday, Thursday) can also be good if volatility is stable.

Days to Avoid or Use Caution:

Fridays may show choppy or unpredictable price action due to traders closing positions before the weekend, leading to false breakouts or whipsaws10.

Days with major economic news releases can cause erratic moves, making IB or ORB less reliable.

Summary

The IB strategy tends to be more robust due to encompassing a full hour of market activity, making it often more profitable than the shorter ORB approach, especially for traders who prefer slightly longer setups and clearer market context2589.