Using the VIX to Choose Between Long Calls and Short Puts: A Volatility-Based Trading Guide

Using the VIX level as a factor in deciding whether to buy long calls or sell puts is a viable approach, but it requires understanding how volatility influences option pricing and risk.

How VIX Levels Affect Buying Calls vs. Selling Puts

VIX measures expected market volatility, derived from S&P 500 index options prices12.

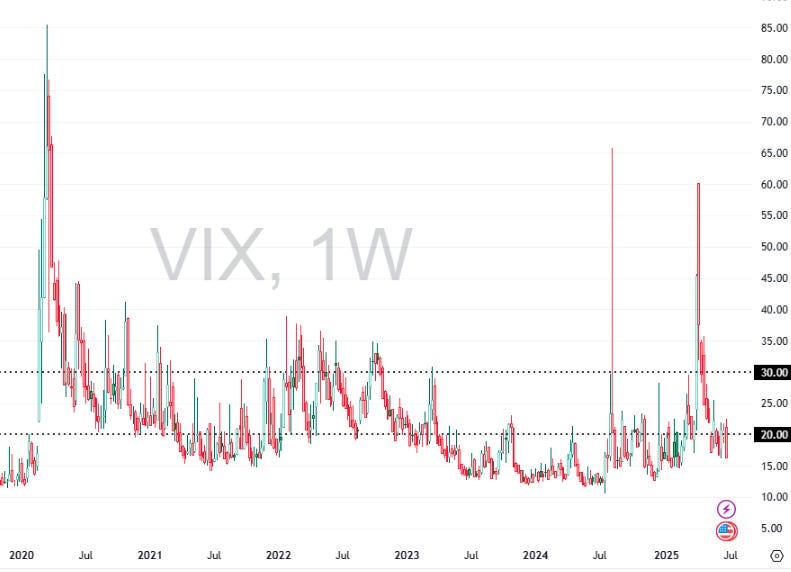

When VIX is high (above ~30), option premiums—including calls and puts—are more expensive due to elevated implied volatility and market fear16.

When VIX is low (below ~20), option premiums tend to be cheaper, reflecting market complacency16.

Implications for Long Calls vs. Short Puts

Buying Long Calls at High VIX:

Calls become expensive as implied volatility rises, increasing the premium you pay. If volatility subsequently falls (which often happens as markets stabilize or rally), the call’s value can decline even if the underlying price rises moderately, hurting returns3.

Thus, buying calls when VIX is very high can lead to paying rich premiums and suffering from volatility crush.Selling Puts at High VIX:

Selling puts when volatility is high allows you to collect larger premiums, enhancing income potential. However, the risk of assignment and large losses also increases if the market drops sharply.

High VIX usually signals increased risk, so selling puts requires caution and risk management14.Buying Calls or Selling Puts at Low VIX:

When VIX is low, buying calls is cheaper, making it more attractive for bullish speculation. Selling puts at low VIX means collecting smaller premiums, reducing income but also indicating lower perceived risk.

Practical Strategy Using VIX Levels

Additional Considerations

VIX tends to mean-revert, so extreme high or low levels usually don’t persist long4.

Market sentiment reflected in VIX can guide timing: high VIX often signals fear (potential buying opportunity for contrarians), low VIX signals complacency6.

Selling puts in high VIX environments can be profitable but requires readiness to manage downside risk and possible assignment1.

Buying calls at market bottoms (often high VIX) can be costly due to high implied volatility, so timing and volatility expectations are critical3.

Summary

Deciding between buying long calls or selling puts based on VIX levels is a viable and commonly used approach:

Use VIX as a volatility and sentiment gauge to assess option premium levels and market risk.

Avoid buying calls when VIX is very high due to expensive premiums and potential volatility crush.

Consider selling puts when VIX is elevated to collect rich premiums but with strict risk management.

Buy calls when VIX is low to capitalize on cheaper premiums and bullish market conditions.

This approach aligns option strategy choice with prevailing market volatility and risk environment, improving the odds of favorable risk-adjusted returns.

Sources:

1 Investopedia on VIX and option premiums

3 Investopedia article on option price-volatility relationship

4 Cboe on VIX futures and volatility characteristics

6 Fidelity on VIX market sentiment and impact